More women are becoming entrepreneurs and business owners than ever before. However, there is still a big disparity in female representation in venture capital firms and founding partner positions. Even with all the disadvantages in front of them, here's how female leaders can be successful in entrepreneurship by understanding the glass ceiling holding them back.

The current state of women in entrepreneurship

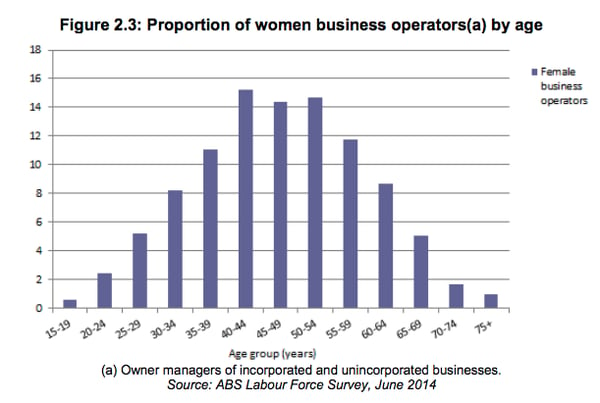

Women make up around one third of business owners in Australia. There’s been a shift in the amount of Australian women who are reaching toward entrepreneurship, seeing a 46% increase in female business owners in the last 20 years.

The current number of female owned business is at 504,838, which is around 33% of business in the Australian market. We also see that the majority of female business owner-operators are in their 40’s and 50’s.

“The relatively low rates of entrepreneurial activity among women represent a key concern for policy, since they signal a clear under-utilisation of entrepreneurial human capital.”

What’s keeping women out of the entrepreneurship

A key issue that is keeping many women out of entrepreneurial ventures is that they struggle the most when it comes to securing investment funding.

“The 2011 AWCCI data shows that metropolitan businesswomen were more likely to use personal savings or credit card debt for start-up funding than regional businesswomen, who were more likely to source funding from banks and credit union loans.” – Australian Bureau of Statistics

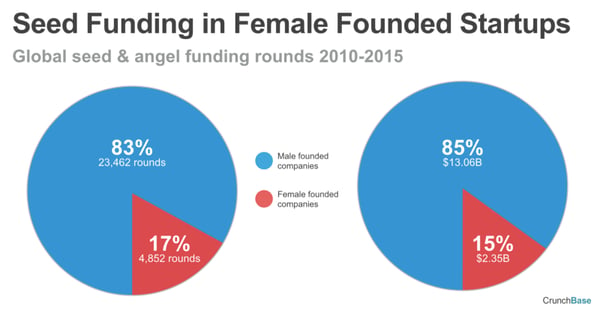

We see that there may be a link between the shortage of female led companies and their ability to access funding — which is extremely disproportionate to that of male led organisations.

No access to mentors

Women lack considerable access to other female mentors. This makes sense, right? With only 7% of women in top venture firms, women are not given the same investment value as men. The lack of female representation in leading venture firms has debilitating effects on female entrepreneurship. Female entrepreneurs say that they have to consistently resort to 'hustle' in order to get through the many obstacles in their way. This is because there is a lack of identifiable female mentors and leaders in investments firms. It doesn’t help when research shows that a typical investment firm will invest in their “own tribe” before taking chances on upcoming new ventures.

Alison Gutterman, CEO of Jelmar, states that she’s had to go find support groups and networks of growth-minded entrepreneurial women in order to keep her spirits high in a male dominated space.

“One of the best things I’ve done to help me in this area is joining a variety of women entrepreneur groups,” she said. “These groups have provided me mentors and peers to inspire me, hit me with reality checks on my capabilities and successes and help be grow and learn from their outside perspectives and experiences.”

Source: Tech Crunch

Source: Tech Crunch

Tech Crunch also found that startups with female founders received as little as 10% of global venture funding and 17% of seed and angel funding.

The question that comes to mind is: how can we invest in female led ventures when we don’t have women in investment firms to start with?

In total, Tech Crunch discovered that women hold just under 12% of partner specific roles in investment firms. The study also found that female founders were actually hiring more women when they led their organisation.

Here's what we can do

Here are some things that we can do to keep hustling and moving forward in our entrepreneurial success:

-

Take action and forget that you’re a woman; you’re a person who brings great value regardless of your gender.

-

Join an entrepreneurial network.

-

Cultivate resilience.

-

Seek out older and more experienced female entrepreneurs through your social networks.