2 Min Read

Every time an employed Australian gets paid, 10.5% of their income is whisked away and invested in their superannuation fund thanks to the Superannuation Guarantee. This money, which is your money, is invested with the intention that when you decide to say goodbye to work and start the never ending holiday that is retirement, this little nest egg will replace your income and pay for your lifestyle in retirement. It’s strange, when you think about it, how much apathy we have toward our superannuation given that for many of us it’s one of the most significant assets we own. Most of us ignore it until we hit our late 40s or early 50s then panic and make drastic moves to try and rapidly boost the balance so we have half a chance of enjoying the same lifestyle that we enjoy today in retirement. It doesn’t have to be that way. By simply paying attention to your superfund and giving it some simple tweaks you can guarantee that you’ll be much wealthier in retirement and it only takes a few hours of your time.

1. Track down your lost super

Remember that restaurant job you had working weekends and a few nights back in your university days? It’s likely that they set you up with a superannuation account as a part of your employment. If you didn’t keep using it and never opened the letters they sent you then there’s a real chance it’s still kicking around and being eaten up by administration fees. In fact, according to the ATO as of June 30 2021, there’s about $13.8Billion in lost superannuation in Australia. That’s an average of $1022 in missing superannuation per working Australian. If that money was claimed and invested in your superfund in your 20s, it could be worth as much at $8,701 in your 60s. The good news is that the ATO runs a free online service called “Find my Super'' to help individuals locate any lost or unclaimed superannuation money they might have.

Figure based on 13.8Billion in lost super (ATO) divided by 13.5Million, which is the number of working Australians according to the Australia Bureau of Statistic

Calculation based on a return of 6.5% less 1% in fees invested and compounded over 40 years. Not adjusted for inflation or taxes.

2. Streamline your funds into one

Consolidating your superannuation into one account can have several benefits including reducing the overall fees you pay, improving the investment strategy and making it easier to manage with only one fund to keep an eye on. Let’s focus on the fee savings alone. If you have more than one superannuation account then you may be paying multiple sets of fees unnecessarily. Take Anna for example, she’s a 35 year old professional who has had several different jobs over the years resulting in her holding three different super accounts with a total balance of $150,000. Presently each account charges 1.5% in fees so she pays $2,250 in fees each year. If she consolidates her accounts into a single fund that charges an annual fee of 1%, however, she reduces that to $750 in fees. By not paying the additional $1,500 in fees each year, she could be $132,337 richer in retirement at age 67.

(NB: Be sure to review any insurances and determine if you want to keep them in place before closing your superfunds. If you’re not sure, seek advice from a suitably qualified professional.)

3. Get low with your fees

Speaking of fees, this is one aspect of your superannuation fund you really want to pay attention to as they have a big impact on your total wealth in retirement.

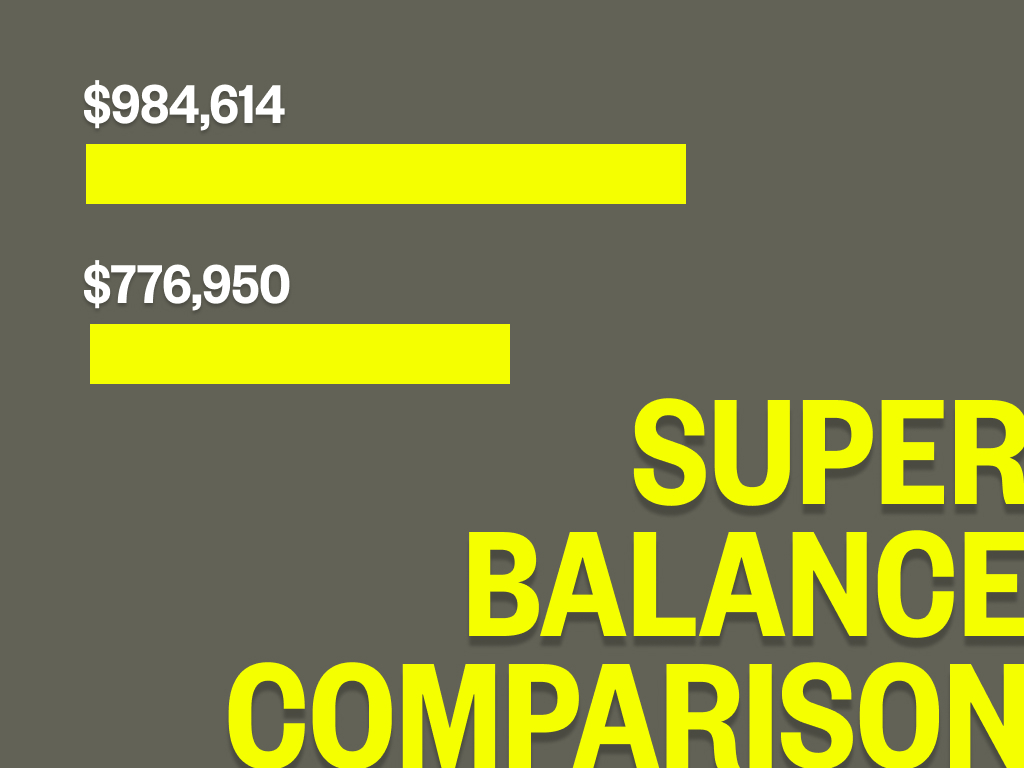

Take Sarah for example. She’s a 30 year old accountant who’s just started working at a new firm. She’s invested her superannuation in a fund that charges 0.5% p.a. in fees. She’s contributing $10,500 a year to her super and plans to retire when she’s 65. Say she gets an annual return of 7% then her balance at age 65 will be $984,614. If she had paid higher fees of 1.5% but got the same return of 7% her balance at age 65 would only be $776,950 - that’s $207,664 less.

So how can you ensure you pay low fees? The best thing to do is compare your fund to others and choose a fund that offers competitive fees and chargers.

Calculation based on a return of 6.5% less 1% in fees invested and compounded over 32 years. Not adjusted for inflation or taxes.

Calculation show in ‘todays’ dollars and adjusted for inflation in terms of 2% per year rise in cost of living and 1.2% per year rise in living standards

4. Give your super a performance review

Whilst comparing your funds fees it’s a good idea to also look at how its been performing compared to other funds. All funds will provide an annual statement but you can also check their website or compare them on independent platforms like ASICs Moneysmart website. Don’t focus on the short term performance of one or three years. You want to look for consistent, high performance over 10 years to get a reasonable understanding of its performance. Again investing with a fund that has a strong performance can make a big difference to your balance.

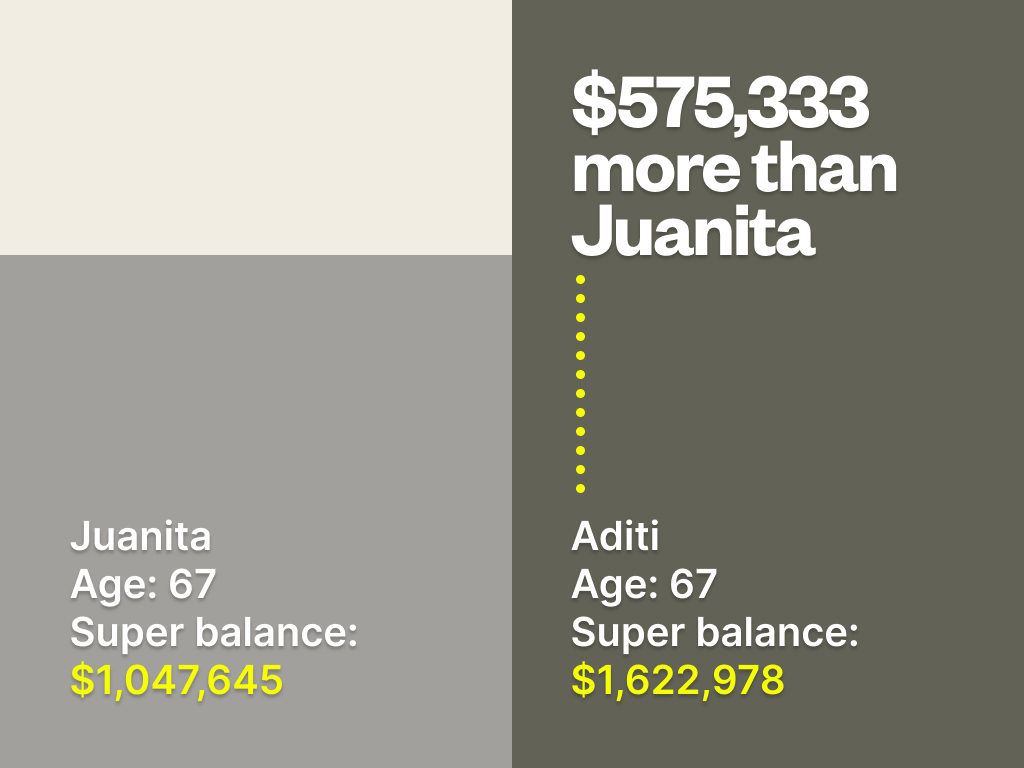

Take Juanita and Aditi for example. Both are 32 years old and working in the IT industry with a super balance of $50,000. Assuming the both keep working until they're 67 and contribute $15,750 a year to their superannuation through the super guarantee. The only difference is Juanita’s fund delivers an average return of 6% after fees while Aditi’s fund returns on average 8% per annum after fees. As a result, Juanita has 35% less money than Aditi in retirement with a balance of $1,047,645 whilst Aditi has $1,622,978.

Calculation show in ‘todays’ dollars and adjusted for inflation in terms of 2% per year rise in cost of living and 1.2% per year rise in living standards.

5. Work that asset allocation

Finally, the last thing you can do to boost your super is ensure that it’s appropriately invested to suit your investment timeframe, objectives and risk appetite. Asset allocation refers to the process of spreading the money you have invested across different asset classes such cash, bonds, property and shares. How your investment is allocated drives much of the returns your superfund achieves. Different asset classes have different levels of historical performance. By allocating your superannuation portfolio to asset classes with historically strong performance, you can potentially achieve higher returns and increase your retirement savings over time. For example, stocks have historically provided higher returns than bonds or cash, but also come with higher risk. Most superfunds will default to a mid-range portfolio unless you direct them to do otherwise so take the time to check the mix of investments aligns with your goals, timeline and objectives.

So as you can see, spending a little bit of time giving your superannuation fund some TLC can literally result in you being hundreds and thousands of dollars richer in retirement. There’s wonderful tools like CompareMySuper that make it easier than ever to compare your superfund but if that still feels overwhelming then be sure to seek advice from a suitably qualified financial professional to help you navigate it. It’s an investment of time that your future self will thank you for.

-2.png?width=1680&height=650&name=ON%20THE%20DEX%20-%20HEADER%20BANNER%20(6)-2.png)

-Sep-06-2024-02-15-01-3122-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Sep-06-2024-02-15-01-3122-AM.png)

-Aug-09-2024-03-23-00-2397-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Aug-09-2024-03-23-00-2397-AM.png)

-Jul-18-2024-09-23-01-9351-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Jul-18-2024-09-23-01-9351-AM.png)