2 Min Read

In an era of soaring living costs, where the price of everyday necessities is accelerating faster than your pay cheque, there is an alarming trend taking hold in many households. Across the nation, a growing number of individuals and families are turning to a seemingly harmless piece of plastic in the face of the cost of living crisis. Credit cards, once reserved for emergencies or indulgences, have become a precarious coping mechanism for many, paving the way for a ticking time bomb of expensive, spiralling debt.

According to data from the Reserve Bank of Australia (RBA) the total purchases on credit cards increased by a huge 17% in the last 12 months to $33.5 Billion in January of this year. Credit cards are a popular, convenient and flexible method of payment that allows users to make a purchase without using cash or immediately deducting funds from their bank account. If the balance of a credit card is repaid in full before the interest free period, which is typically around 55 days, then no interest is charged to the user. If they are unable to pay the balance in full or simply make the minimum repayment, then expensive interest will be added to the balance of the account. This is where users can really get themselves into trouble.

While credit cards can be a useful financial tool when used responsibly, relying on them to make ends meet creates a dangerous cycle of debt and financial instability. What begins as a seemingly harmless strategy to bridge the gap between your income and expenses one month can quickly escalate into something more challenging when coupled with unexpected expenses like emergency repairs, health care or a spike in bills. Resulting in users quickly struggling to pay off the debt as interest and fees accumulate creating sustained financial fragility that impacts their credit score, personal agency and wellbeing. Those most vulnerable to experiencing credit card debt include low-income earners, young adults, individuals with insufficient savings, those experiencing redundancy or job loss, those with existing debt burdens (i.e. mortgages), impulse purchasers, shopaholics and individuals with poor money management skills.

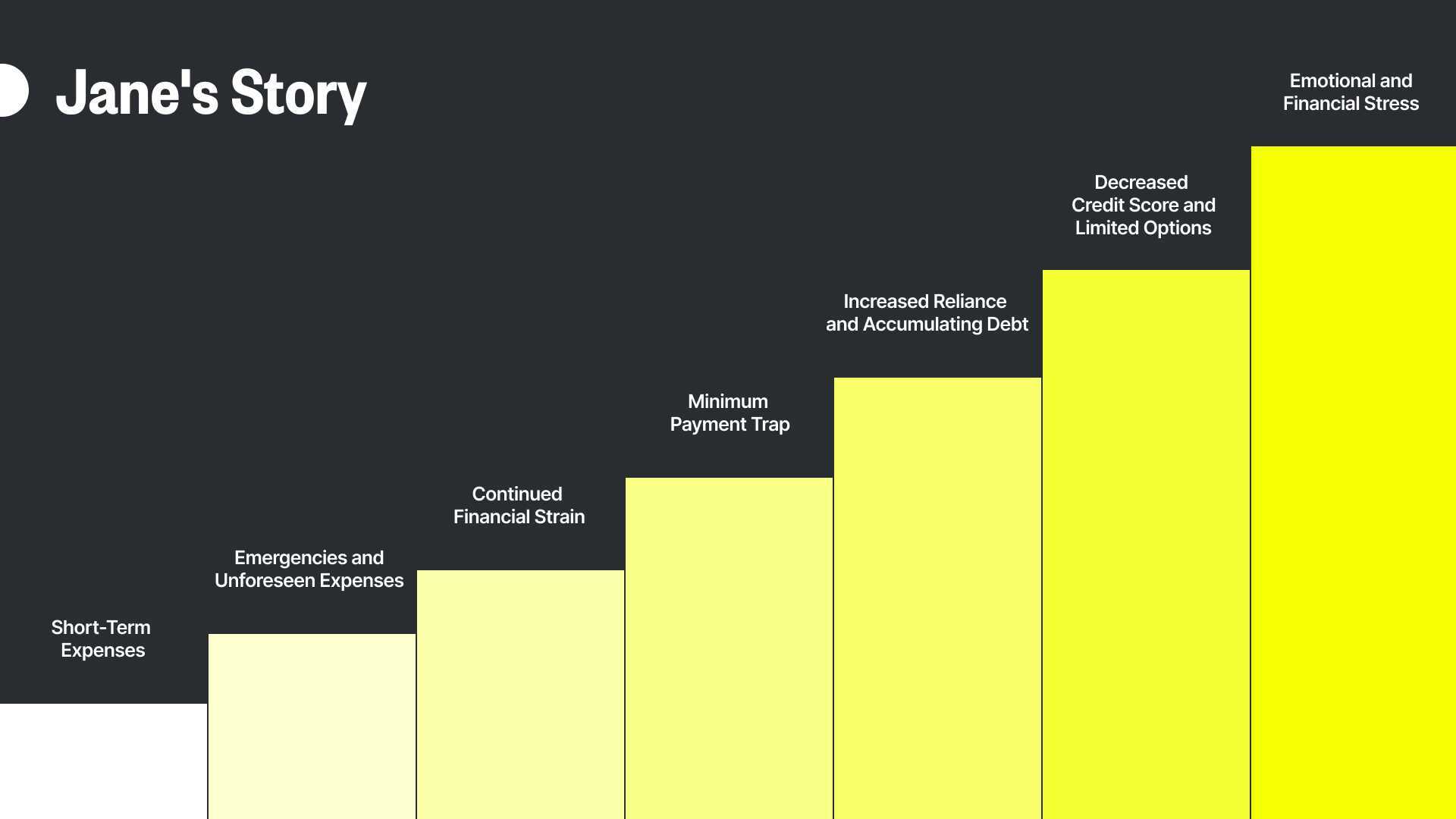

Jane’s Story

Jane, a single parent with two children, faced a cost of living crisis due to a sudden increase in essential expenses, namely her rent. Here's how her situation escalated into a debt spiral:

· Short-Term Expense: Jane's rent increased significantly due to changes in the housing market. Unable to cover the higher rent with her existing income, she decided to use her credit card to pay the difference for that month, considering it as a short-term solution to bridge the gap.

· Emergencies and Unforeseen Expenses: A few weeks later, Jane's car broke down. Given she needs it for her daily commute to work and to drop off her children at school she needed to get it repaired quickly. Lacking sufficient savings for the car repair, she relied on her credit card to cover the cost.

· Continued Financial Strain: With the increased rent and unexpected car repair, Jane's monthly expenses had risen significantly. She struggled to meet her basic needs, such as groceries, utilities, and child-related expenses. Again, she chose to use her credit card to cover these expenses.

· Minimum Payment Trap: As Jane started relying more on her credit card, she could only afford to make minimum payments each month due to her limited income. The remaining balance incurred high-interest charges, further increasing her overall debt.

· Increased Reliance and Accumulating Debt: Unable to break the cycle, Jane continued to use her credit card to cover ongoing living expenses, creating a growing balance on her card. The interest charges accumulated, making it increasingly difficult for her to catch up and pay off the debt.

· Decreased Credit Score and Limited Options: As Jane's credit card balance grew and her ability to make timely payments diminished, her credit score began to decline. This, in turn, limited her access to affordable credit options, further trapping her in the debt spiral.

· Emotional and Financial Stress: The mounting debt and financial strain took a toll on Jane's emotional well-being. She began to experience stress, anxiety, and sleepless nights as she struggled to find a way out of the debt spiral.

To break free from the debt spiral required Jane to address the underlying cost of living crisis by exploring alternative solutions such as seeking financial assistance. She adjusted her budget and reduced expenses by moving to a cheaper rental. Furthermore, she’s exploring how she can increase her income to accelerate her ability to pay off the debt and build up emergency savings. The experience has shaken Jane and motivated her to prioritise improving her financial education to regain control over her finances and work towards long-term financial stability.

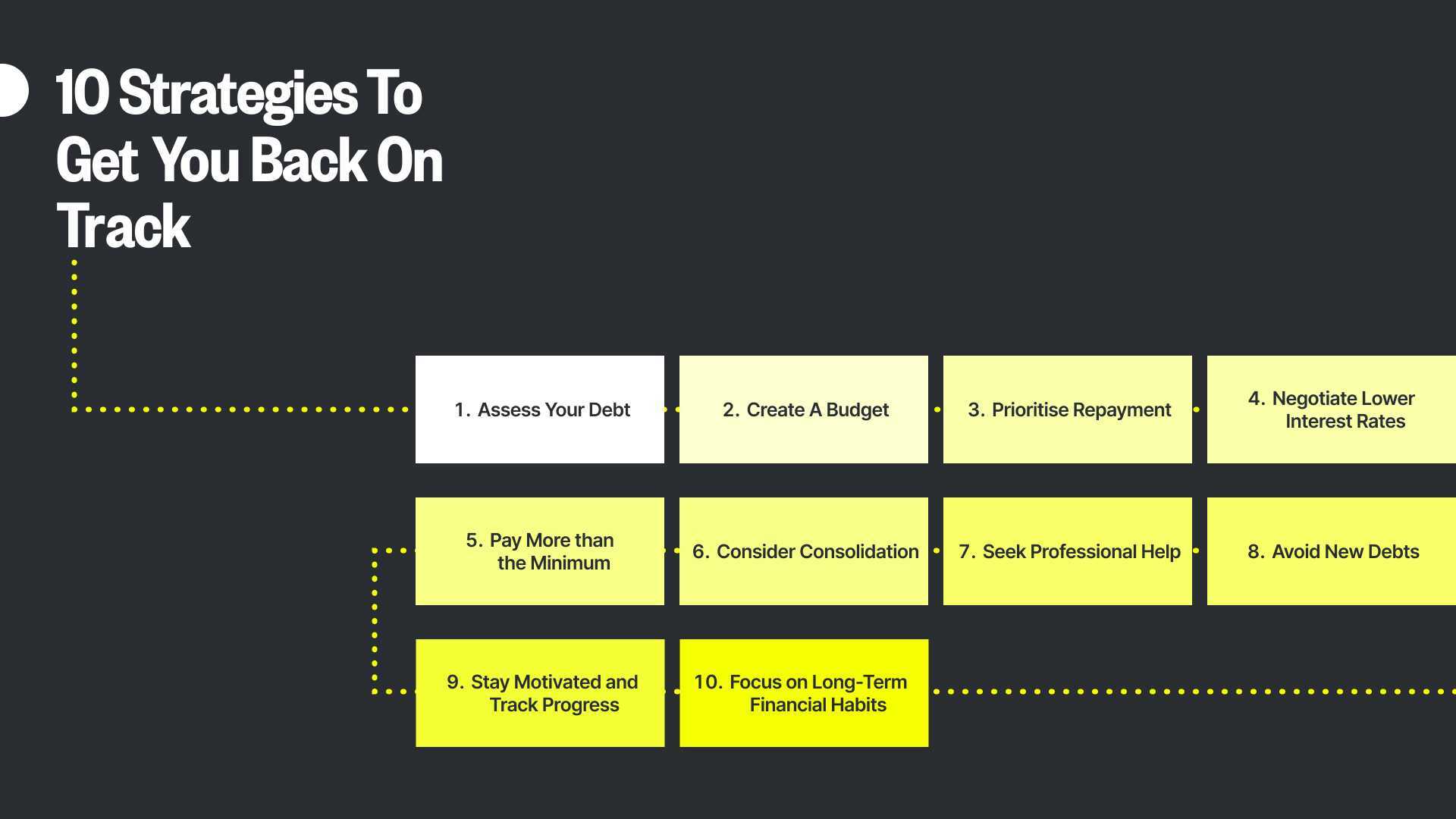

As highlighted with Jane’s story, getting out of a debt cycle can be challenging but with careful planning and determination it is possible. Here’s ten strategies that will get you back on track:

- Assess Your Debt: Write down a list of all your debts including the outstanding balances, interest rates, and minimum payment requirements for each card.

- Create a Budget: Develop a realistic monthly budget that outlines your income and expenses. Identify areas where you can reprioritise non-essential spending in favour redirecting that cash to paying off your debt.

- Prioritise Repayment: Determine a repayment strategy that works for you and will keep you motivated. Two common approaches are the "Debt Snowball" method (paying off the smallest balance first) or the "Debt Avalanche" method (paying off the highest interest rate balance first).

- Negotiate Lower Interest Rates: Contact your credit card issuers to inquire about the possibility of lowering your interest rates. Lower interest rates can help reduce the overall cost of your debt and accelerate your repayment progress.

- Pay More than the Minimum: Aim to pay more than the minimum payment due each month. By paying more, you can tackle the principal balance more aggressively, reducing both the interest charges and the time it takes to pay off the debt.

- Consider Consolidation: Explore the option of consolidating your credit card debt into a single loan or transferring balances to a credit card with a lower interest rate. This can simplify your repayment process and potentially save you money on interest charges.

- Seek Professional Help: If your debt is overwhelming or you're struggling to make progress, consider seeking assistance from a financial counsellor. They can provide guidance, negotiate with creditors, and help you develop a personalised debt management plan.

- Avoid New Debts: While paying off your existing credit card debt, it's crucial to avoid adding more debt. Put your credit cards away or even consider freezing them temporarily until you regain control over your finances.

- Stay Motivated and Track Progress: Celebrate small victories along the way and track your progress. This can help you stay motivated and committed to your debt repayment goals.

- Focus on Long-Term Financial Habits: Use this opportunity to develop healthy financial habits. Build an emergency fund to handle unexpected expenses, practice responsible spending, and save for future goals.

Financial hardship can happen to anyone, especially when things outside of your control happen like a sudden spike in the cost of living, relationship breakdown or job loss. To those facing financial hardship, remember that tough times are temporary. You are not defined by your current situation. Seek support, create a budget, and take small steps towards improvement. Believe in your strength, resilience, and ability to overcome challenges. Stay positive, celebrate even small victories, and prioritise self-care. Your circumstances don't determine your future. Keep moving forward, remain hopeful, and work towards a brighter financial future.

-May-24-2023-03-37-14-2363-AM.png?width=1680&height=650&name=ON%20THE%20DEX%20-%20HEADER%20BANNER%20(1)-May-24-2023-03-37-14-2363-AM.png)

-Sep-06-2024-02-15-01-3122-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Sep-06-2024-02-15-01-3122-AM.png)

-Aug-09-2024-03-23-00-2397-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Aug-09-2024-03-23-00-2397-AM.png)

-Jul-18-2024-09-23-01-9351-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Jul-18-2024-09-23-01-9351-AM.png)