2 Min Read

For many Australians, buying their first home can seem like an unattainable dream, especially in today's competitive housing market and amidst the cost of living crisis. However, one strategy that has gained popularity in recent years is teaming up with a friend and family member to buy our first home. In fact, research from Commbank in 2021 suggests that as many as 1 in 4 first home buyers have considered buying a home with a non-traditional partner. By pooling resources, buyers can share the costs and increase their borrowing power, making it easier to get onto the property ladder sooner. It seems the trend has the nod from the Australian Government with an announcement to allow siblings, family members and friends to team up and apply for the First Home Owners & Regional First Home Owners Guarantee scheme from July 1. The question is, is it a good idea to buy a home with someone who isn’t your partner?

Home Guarantee Criteria expanded

This week the Federal Government announced plans to expand the criteria for the Home Guarantee Scheme in an effort to address the Housing Affordability Crisis. In relation to both First Home Owner Guarantee and Regional First Home Owner Guarantee scheme joint applicant eligibility will be expanded from those that are married or in a de facto relationship to also include siblings, family members and even friends! Furthermore, permanent residents will be eligible to apply along with individuals who have owned a home before but not in the last 10 years making millions more Australians eligible to participate from July 1st, 2023.

How does it work

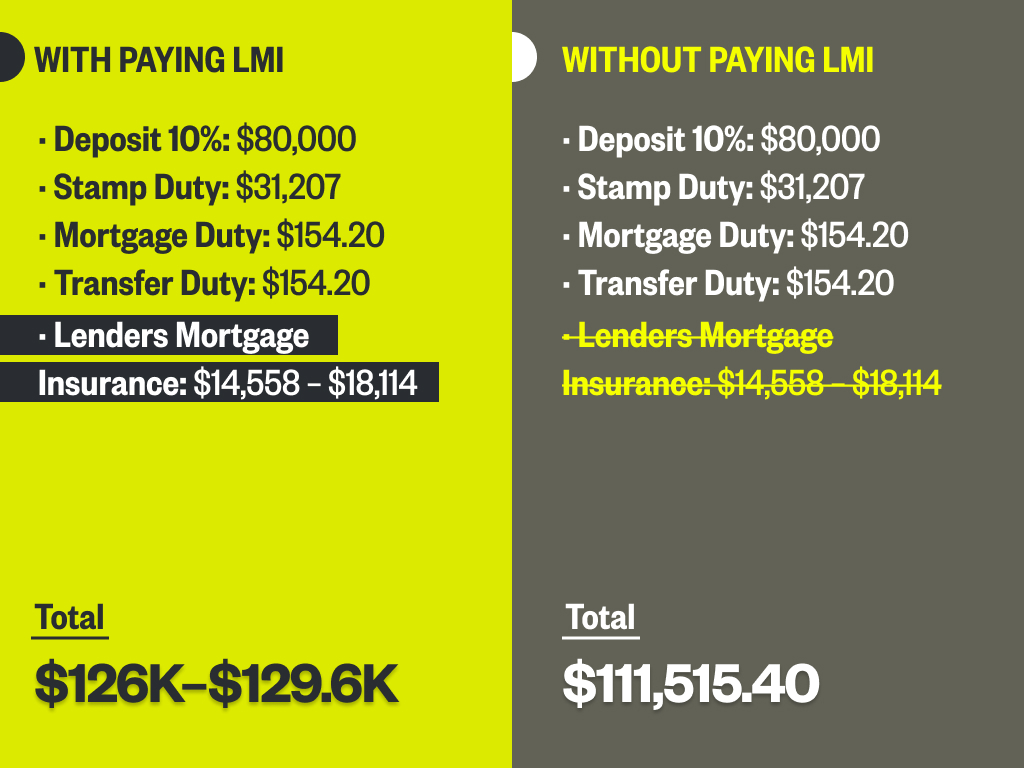

Under the scheme a home buyer can buy a home with a deposit as low as 5% and avoid paying Lenders Mortgage Insurance. The government acts as a guarantor on the loan up to 15% of the value. To explain, Lenders Mortgage Insurance (LMI) is something banks charge when a borrower has a deposit of less than 20% when purchasing a property. It’s an insurance policy that protects the bank (not the borrower) from incurring a financial loss in the event the borrower defaults on their loan repayments. LMI can be quite expensive, typically ranging between 1% and 2% of the purchase price depending on how large the loan is and the size of the borrower's deposit. Being able to buy a home with a smaller deposit and not have to pay LMI is a huge cost saving to borrowers. For example, LMI on a purchase of an established property worth $800,000 in NSW can cost anywhere from $14,558-$18,114 for a First Home Buyer. Being able to avoid LMI enables First Home Buyers to get into the property market sooner, assuming they meet all the other lending criteria including the ability to afford a larger loan along with the Home Buyer Guarantee criteria too. It’s worth noting that there’s only a select number of home lenders and financial institutions approved to provide loans under this scheme. For the full list, head to the National Housing Finance and Investment Corporation website.

Is co-purchasing a home a good idea?

So regardless of whether you're taking advantage of the Home Buyer Guarantee scheme or not, is it a good idea to co-purchase a home with a family member or friend? It’s likely to be a long term commitment with data from Core Logic indicating that most homeowners hold onto their property for 11.3 years. Certainly it can be an effective way to boost your purchasing power but the reality is that it can be a minefield with the potential to ruin a relationship.

Five essential conversations to have before you buy

So before you sign any purchase contract or start bidding on properties together here’s some essential things to discuss and plan beforehand:

- Communication: Open and honest communication is crucial when buying a house with a family member or friend. Make sure you have a clear understanding of each other's expectations and goals for the property, and that you discuss any potential issues or conflicts that may arise. It’s a good idea to set a cadence to review and discuss the arrangement after the purchase. Doing this once every 12 months is a good rule of thumb.

- Legal considerations: It is important to have a written agreement in place that outlines each party's responsibilities and obligations. You should also discuss ahead of time what the ownership structure will be - will you be joint tenants, tenants in common or will you set up a company or trust structure? Speak to suitably qualified professionals for guidance and advice like a lawyer, accountant or financial planner. The structure of the ownership may impact your loan application so be sure to loop in your lender too.

- Financial considerations: Make sure you have a clear understanding of each other's financial situation and that you have a plan for sharing the costs of the property, including mortgage payments, maintenance, repairs, and utilities. It’s important to consider how you will manage unexpected expenses or what would happen if one of you were to lose their income. This is where personal insurance, general insurance and emergency savings can be useful and provide peace of mind.

- Exit strategy: It is important to have a plan in place for what will happen if one party wants to sell their share of the property. Life changes, one of you might meet a long term partner or decide you want to move abroad, for example. Having a plan in place on how to handle these scenarios will go a long way to reduce any unnecessary stress, angst or conflict.

- Lifestyle and living arrangements: If you are buying a house with a friend or family member, you may need to consider how your lifestyle and living arrangements will work together. For example, will you share communal spaces like the kitchen and living room, or will you each have your own separate areas? Your goal is to live amicably together for a long period of time. With that in mind, what needs to happen and how do you need to behave to ensure it does.

By being mindful of these considerations and discussing them openly with your friend or family member, you can help ensure a successful and positive experience when buying a house together. And live happily, ever after.

Upfront Cost Comparison

NB: The calculations do not include costs like conveyancing, bank fees, general insurance or moving costs and may not be an accurate representation of all the costs associated with purchasing a property.

-4.png?width=1680&height=650&name=ON%20THE%20DEX%20-%20HEADER%20BANNER%20(10)-4.png)

-Sep-06-2024-02-15-01-3122-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Sep-06-2024-02-15-01-3122-AM.png)

-Aug-09-2024-03-23-00-2397-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Aug-09-2024-03-23-00-2397-AM.png)

-Jul-18-2024-09-23-01-9351-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Jul-18-2024-09-23-01-9351-AM.png)