2 Min Read

As far as Australian dreams go, the desire for homeownership stands as an enduring aspiration for many individuals. It’s the allure of having a place to call your own, a sanctuary to cherish memories and build your future that resonates the most. If you’re navigating this milestone, you're likely aware that there's more than one path to achieve it - traditional home ownerships or the growing trend of rentvesting. Which route is best for you? Let's embark on a journey of exploration, as we delve into the pros and cons of both options and explain why it’s important to get advice when navigating this decision.

Rentvesting explained

Home ownership is widely understood, unlike the concept of rentvesting which is a relatively new phenomenon. Rentvesting is a homeownership strategy where you rent a property to live in that’s right for your lifestyle, while you own an investment property that’s right for your budget.

As home prices in capital cities have skyrocketed, this strategy has become increasingly popular, especially among younger buyers.

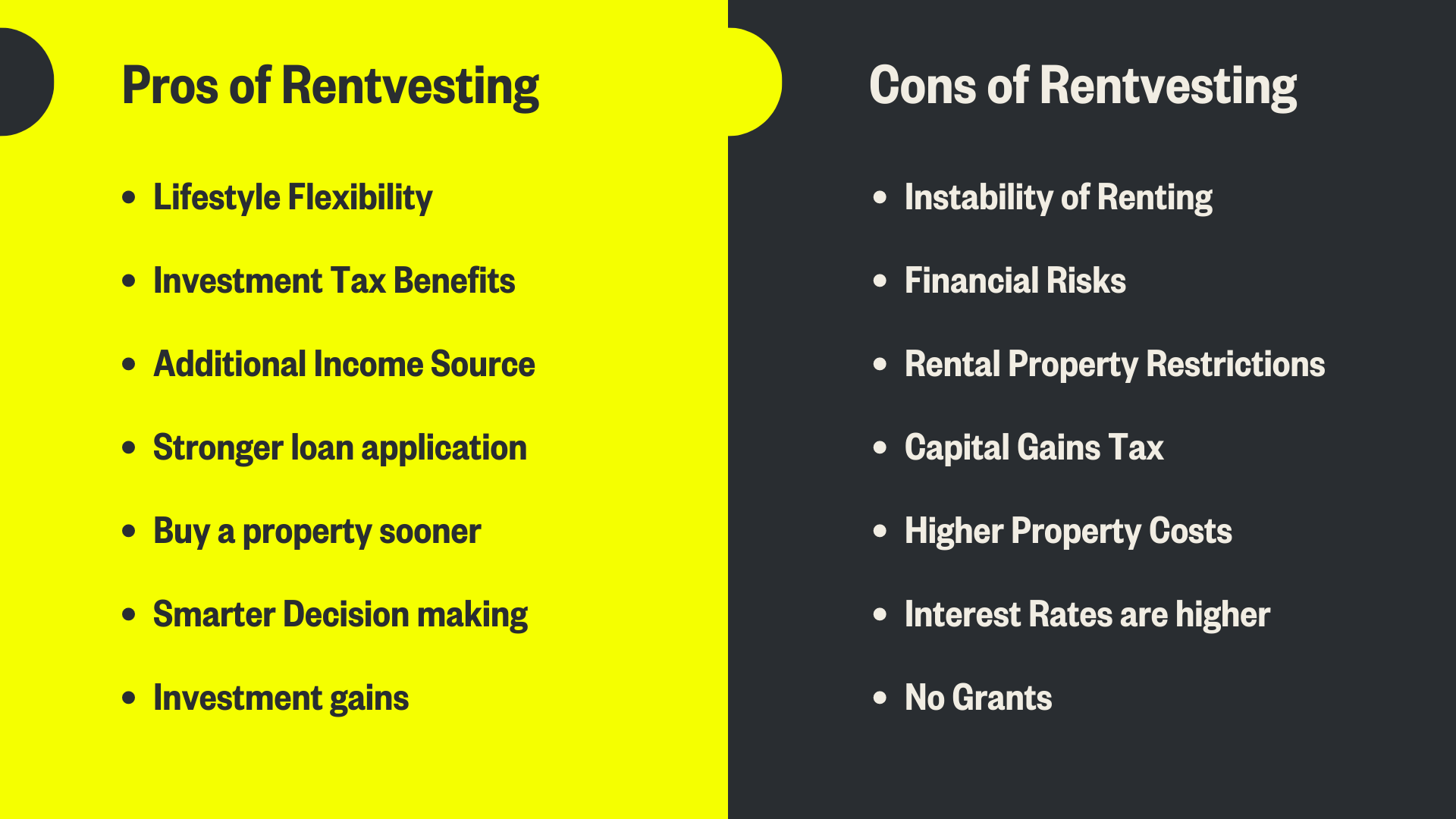

Pros and Cons of Rentvesting

The Pros:

- Lifestyle Flexibility: By rentvesting you can maintain your lifestyle by living in your preferred suburb that may be too expensive to buy into. This also means you can relocate and upsize/downsize the home more easily than if you were living in a home you owned.

- Investment Tax Benefits: Owning an investment property may come with certain tax deductions and advantages that could be beneficial to you.;

- Additional Income Source: If the rental income from your property is in excess of the cost of the loan and property maintenance, this can be directed toward reducing your own rent expenses or used to boost other savings and investments;

- Stronger loan application: A cheaper property means a lower home loan which will increase the strength of your loan application;

- Buy a property sooner: A cheaper property purchase means you don’t have to say as large of a home deposit and get potentially get into the property market sooner;

- Smarter Decision making: A home purchase can carry a lot of emotion whereas an investment property purchase is more likely to be based purely on logic; and

- Investment gains: Assuming the property increases in value, you can make significant gains on the money you invest.

The Cons:

- Instability: A landlord has ultimate control over the property and may ask you to vacate which creates instability in your living arrangements:

- Financial Risks: With any property investment there’s the risk that the property may be vacant resulting in lost income or may not grow in value as expected;

- Rental Property Restrictions: As a renter in Australia there are limitations on how much you can personalise a property you’re living in;

- Capital Gains Tax: As an investment property, and assuming you don’t live in it, you will have to pay Capital Gains Tax when you eventually sell the property;

- Higher Property Costs: As a rentvestor you will have to pay for the costs associated with living in your rental property (utilities etc) and the maintenance of your investment property;

- Interest Rates are higher: Interest rates on investment property loans are higher than that on owner occupied home loans; and

- No Grants: As you are purchasing an investment property, you won’t have access to first home buyer grants or subsidies

Pros and Cons of Home Ownership

.png?width=1920&height=1080&name=wealth%20gap%20%20(1).png)

The Pros:

- Wealth Creation: It can help you build up your wealth as house prices have always increased over the long term, which you can pass onto your children or use as collateral to buy a second home;

- Forced Savings: Each home loan repayment builds the equity in your home and forces you to save some of the money you earn which can be helpful if you’re not naturally inclined to save;

- Stability & Control: Buying a home provides you with certainty because there's no risk that you'll be displaced by a landlord. Furthermore, you can decorate or renovate your home however you please;

- Capital Gains Tax Exemption: As your primary place of residence, your home is exempt from capital gains tax when you sell it;

- Flexibility: You can choose to rent out your property if you want to live somewhere else, so your tenant is paying off your mortgage.; and

- Access to Government Incentives: As a home buyer you may be eligible for grants and schemes to support your home purchase.

The Cons:

- Your Home isn’t really an Investment: You live in your home and whilst it can be worth a lot of money it doesn’t give you a lot of financial benefit like other assets do. It’s important to get the balance right between the value of your home and the value of other investments to create true wealth. If all of your wealth is tied up in your home then you’ll eventually need to sell it and downsize for you to access the capital which might not be something you want to do;

- Ongoing maintenance expenses: Homeowners must pay for things like upkeep, repairs, and property taxes. There may be additional fees if your home is located in a body corporate community. When you add everything up, these costs can quickly become unmanageable.

- Cost of interest: You pay interest on the money you borrow to purchase your home which can be significant over the life of a loan; and

- Limited diversification: Saving your deposit and then paying down a mortgage of a home owner can limit your ability to invest in additional investments resulting in your wealth being concentrated in a single asset.

You’ve got to crunch the numbers

Determining what’s going to be the best financial outcome for you will be influenced by a number of financial factors. It pays to do your own analysis. It also pays to consult with a financial advisor or property expert to get personalised guidance. They can help you analyse your financial situation, weigh the pros and cons, and make an informed choice. Things to consider in your analysis include:

- Affordability and Upfront Costs: Compare the upfront costs of different property purchases, including the deposit, stamp duty, legal fees, moving costs and rental bonds.

- Mortgage vs. Rent Payments: Assess the monthly mortgage payments you'd be making if you were to buy a home, considering the interest rate and loan term. Compare this amount to the monthly rental payments for a property you'd consider if rentvesting.

- Rental Income and Investment Potential: If you choose rentvesting, analyse the rental income you could potentially generate from the investment property. Evaluate the investment potential of the property over time, considering factors like potential capital appreciation and rental yield.

- Tax Benefits and Deductions: Understand the tax benefits and deductions associated with both options.

- Opportunity Cost: Assess the opportunity cost of buying a home, including the potential returns you could achieve by investing your down payment elsewhere, such as in share or other assets. Compare this opportunity cost to the potential benefits of property ownership and rental income.

- Property Market Conditions: Research the current state of the property market, both in the area you wish to buy and in potential rentvesting locations. Consider factors like property prices, rental demand, and market trends.

- Risk Tolerance: Analyse your risk tolerance and capacity to handle market fluctuations and potential vacancies if you opt for rentvesting.

How to make the right choice for you

When choosing between buying a home or rentvesting, it's a highly personal decision shaped by emotions and finances. Each option has its pros and cons, depending on your circumstances and goals. Consider your stability, affordability, lifestyle, and future plans. Evaluate investment potential, market conditions, and tax implications. When in doubt, seek expert advice! There’s no one-size-fits-all answer—weigh up all aspects to find the solution that’s most aligned with your aspirations and financial well-being.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.

-3.png?width=1680&height=650&name=ON%20THE%20DEX%20-%20HEADER%20BANNER%20(13)-3.png)

-Sep-06-2024-02-15-01-3122-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Sep-06-2024-02-15-01-3122-AM.png)

-Aug-09-2024-03-23-00-2397-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Aug-09-2024-03-23-00-2397-AM.png)

-Jul-18-2024-09-23-01-9351-AM.png?width=596&name=ON%20THE%20DEX%20-%20%20THUMBNAIL%20(38)-Jul-18-2024-09-23-01-9351-AM.png)